Complete Guide to Choosing Multibagger & Wealthtrust Multi-Dimensional Portfolio

Wealthtrust Capital Services designed a Multidimensional Portfolio to bring investment opportunities having the potential for explosive growth. Launched in March 2024, this portfolio is managed by Wealthtrust Capital Services providing access to high-growth companies with the potential to give multi-bagger returns.

In this blog, we will discuss in detail the intricacies of 'Multidimensional Portfolio' curated by Wealthtrust Capital Services – the portfolio approach, Sectors invested, key metrics for stock selection and how you can start investing.

Unique Approach to Multidimensional Portfolio

Our Multidimensional Approach to Stock Selection is picking high-growth companies that have the potential to acquire market share from their competitors- particularly from large-cap players. In our experience, we have seen such companies becoming multi-baggers.

Here’s a detailed breakdown of our approach with Multidimensional Portfolio:

With our experience and research, we have identified stocks in the small-cap category that have strong fundamentals coupled with the potential to acquire market share of its competitors. One of our stock picks Neuland Pharmaceuticals has almost doubled in a very short time.

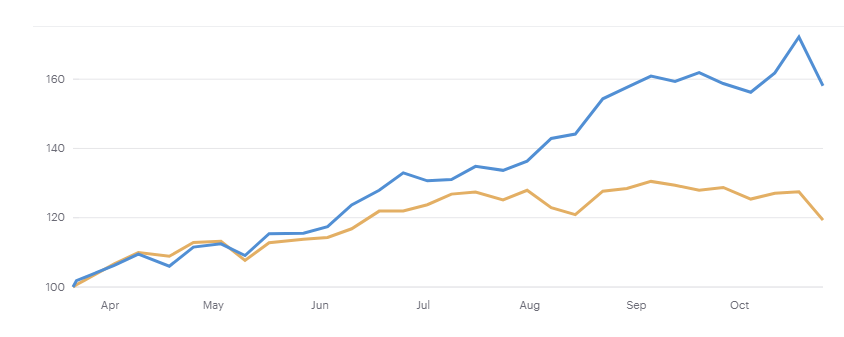

Looking at the 7 months performance, the Multidimensional Portfolio has outperformed the Equity small-cap index by a stellar margin.

Our Secret for Finding Multi-bagger Stocks

Our Investment strategy begins with identifying high-growth sectors through our research team and technical tools. Generally, mutual fund managers invest in the leading companies of these sectors according to the fund’s market cap restrictions. We differentiate our approach by picking companies having the potential to acquire market share from their competitors, maintaining the margin growth as well.

We conduct a thorough scrutiny of fundamentals analyzing liquidity, margins and working capital flows. Along with fundamentals, analyzing valuation and deciding on a cheaper entry point makes us identify potential multi-bagger stocks.

Our Key Metrics for Stock Selection

Selecting Stocks is a mix of analysing technical metrics to having the conviction from experience. Finding a multi-bagger stock is also about getting earning surprises, catching the attention of FIIs & DIIs and favourable government policies in a particular sector.

So, here are some key metrics that we use to identify potential Multi-bagger stocks for this portfolio:

We differentiate our approach by not just looking at the price trend but also the PE trend. The scope of PE expansion and contraction gives a sneak peek into the psychology of the market. With our experience and observation, we have seen stock prices skyrocketing when there is an increase in PE – fueled by earnings growth and positive market sentiments towards that stock.

Keeping a close eye on government spending can help to identify sectors – witnessing huge demand in the coming years. Our research team reads through the fine print of Budget announcements, keeps track of sectors focused on by the government and analyzes the impact of government policies. For example, companies in the defence sector benefitted from the increased government spending.

Apart from the fundamentals of the company, we analyze unsystematic risk through capex plans. This metric is not only important from a margin perspective but also from the liquidity viewpoint. Companies funding their capex through internal accruals could have a faster margin expansion due to less burden of interest payments.

Investment Patterns of FIIs & DIIs

Stock Exchanges work on a simple mechanism of demand and supply. Short-term demand is often fueled by the sentiments, quarterly results and news around the stock. Long-term demand in the market is driven by the fundamentals and recognition of FIIs and DIIs in the stock. Looking at the past market trends, stocks have taken a euphoric turn when the DIIs and FIIs have started investing in them. Once, a fundamentally strong stock catches market attention, there is no looking back for it.

Spotting these key metrics and a continuous observance of emerging trends helps in recognizing potential multi-bagger stocks.

How Do We Manage Risk?

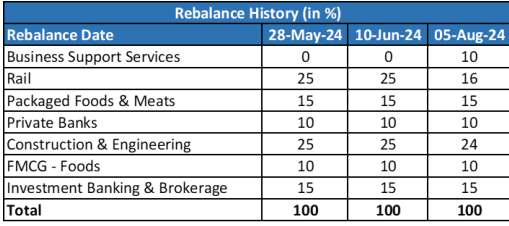

Following our risk management protocol, we do not take concentrated positions in a particular sector – diversifying by taking a multi-sector approach.

Our rebalancing approach is unique with no fixed schedules but are rebalanced only to capture new market opportunities or any emerging trend. With a continuous eye on the sector performances, we have rebalanced this portfolio around 4-6 times a year.

In just 7 months, this portfolio has produced two multi-bagger stocks — Neuland Laboratories and Titagarh Rail Systems. Both these stocks had the potential to be a leader in their respective industry and challenge their competitors. We entered these stocks when these were available attractive multiples and employed strategies to acquire market share.

Why Should You Invest in Multidimensional Portfolio?

Investing in high-growth potential companies is crucial for the achievement of financial goals. With 12% medical inflation, 14% education inflation and a necessary lifestyle upgrade, companies with high-growth potential can only fare you through these milestones.

This portfolio is designed to unleash explosive growth and can also provide you with much-needed diversification to your overall investment portfolio.

This handmade portfolio by Wealthtrust Capital Services could make your equity investment journey a multi-bagger one.

Click here to begin your Multi-bagger journey today.