Wealthtrust Capital Services has curated the Inflation Resistant Portfolio to keep your portfolio thriving during adverse market conditions. Launched in 2022 and managed by Wealthtrust Capital Services, this carefully selected basket of investments takes a conservative approach, offering a safety net during bearish markets. Though designed to withstand downturns, this portfolio has also delivered strong performance in bull markets, making it a reliable all-weather option.

In this blog, we will discuss in detail the intricacies of the Inflation-Resistant Portfolio– the portfolio strategy, its asset allocation, past performance compared to the benchmark index, and how you can start investing.

Thought Process Behind This Portfolio

The Russia-Ukraine War in 2022 brought a lot of market instability leaving investors in search of safe investment options that could yield inflation-beating returns. We identified this gap in the market and launched this portfolio. But, it is not just limited to this incident. The geopolitical factors have started affecting the economies directly due to globalisation. The supply chain management gets disrupted whenever there is a war having a spiral effect on the businesses.

During these tough times, the US stance further influences global trade and moves. For example, during the Russia-Ukraine war, the US froze the assets of Russia held in US dollars to support Ukraine. This portrayed the US Dollar as highly unreliable in tough times. The world economies since then have started building up their gold reserves as an alternate medium of exchange.

With such observance of changing geopolitical scenarios, we curated an inflation-resistant portfolio that will not only protect the capital during tough times but also reap inflation-beating returns.

Our Approach to Asset Allocation

Putting a safe investment strategy in place, we have allocated around 50% in equity and 50% in debt. Observing an increasing demand, we have allocated a major investment in Gold in the debt category. To keep the returns consistent, most of the equity category contains large-cap companies.

Equity Allocation Strategy

In bear markets, sectors like FMCG generally perform better because people spend more on necessities during tough times. The Crude Oil prices also shoot up in tough times which increases the focus on alternative energy sources. The power sector catches the limelight in such situations. We placed more weightage on FMCG & Power Stocks having attractive valuations. This proactive strategy has created not only an inflation-resistant portfolio but also beaten the Equity Large-cap benchmark.

An interesting point to note here is this portfolio comprises only around 50% investment in large-cap but still has managed to beat the large-cap index.

Debt Allocation Strategy

Around 14% of the capital has been allocated in Gold coupled with 32% in debt. The strategy was to protect the portfolio from market volatility while still reaping inflation-beating returns. During geopolitical tensions, the FIIs start moving their capital towards their safer investment classes, particularly debt. This part of the portfolio protects your capital from volatility. Gold and Silver have acted as a safe bet due to decreasing reliance on US dollars and increasing industrial production respectively.

How do we Manage Risk?

Our Research Team with its quantitative tools identifies the fairly priced companies even in large-cap. A common market notion is that large-caps have given lower returns in the past 2 years but thanks to our mechanisms, we had spotted the undervalued stocks and had entered at the right time. Finding undervalued stocks is our very first metric while stock selection.

Another strategy is our low turnover ratio with just two rebalances in the past 2 years. This approach has compounded the consistent returns maintaining a long-term holding position. Also, while rebalancing we maintain the original allocation ratio of debt and equity sticking to the theme of inflation-resistant. With this conservative approach, this portfolio is prone to medium volatility making it a consistent compounder portfolio for you.

Market Reaction Amid Geopolitical Tensions

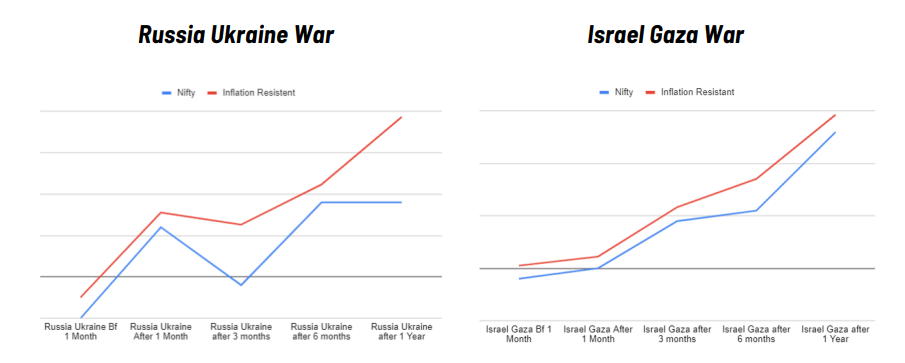

Whenever war breaks, the market has fallen. However, this portfolio has fared the investors from the Russia-Ukraine War and Israel-Gaza War with a green portfolio. Clearly, the Inflation-resistant Portfolio has outperformed the Nifty in bearish market conditions.

Why Should You Invest in Inflation-Resistant Portfolio?

The Stock markets have been reacting to the geopolitical tensions making it a necessity to have an investment geared up for such times. Whether it's the US Fed rate, China declaring economic stimulus or the Iran-Israel war, the effect of these events could be seen in your portfolio. So, hedging your investments against the volatility caused by these geopolitical events is the need of the hour for any investor.

Apart, from saving you from volatility, this portfolio also gives the much-needed diversification to your overall investment portfolio – performing well in both bear and bull markets.

With the security of capital protection and consistent returns, this portfolio is a must-have for reducing your investment risks.

Click here to begin your Inflation-Resistant journey today.